Bank of America is one of the largest and most reputable banks in the United States, providing a wide range of financial services to its customers. One of the key features offered by Bank of America is its online banking platform, which allows customers to conveniently manage their accounts, make transactions, and access various banking services without having to visit a physical branch. In this article, we will explore the process of setting up Bank of America online banking, discuss the benefits it offers, delve into the security features implemented to protect user information, provide guidance on managing accounts, transferring funds, and making bill payments. We will also touch upon mobile banking options and offer troubleshooting tips for common issues that may arise. Let’s dive into the world of Bank of America online banking!

Bank of America Online Banking Services

Bank of America’s online banking services provide customers with a host of valuable tools and features to simplify their financial management. Through the online platform, users can access their accounts 24/7, from anywhere with an internet connection. The services offered include:

- Account balance inquiry

- Transaction history review

- Fund transfers between Bank of America accounts and external accounts

- Bill payment options

- Check deposit through mobile devices

- Loan applications

- Account statement retrieval

- Personalized financial insights and recommendations

- Budgeting and goal-setting tools

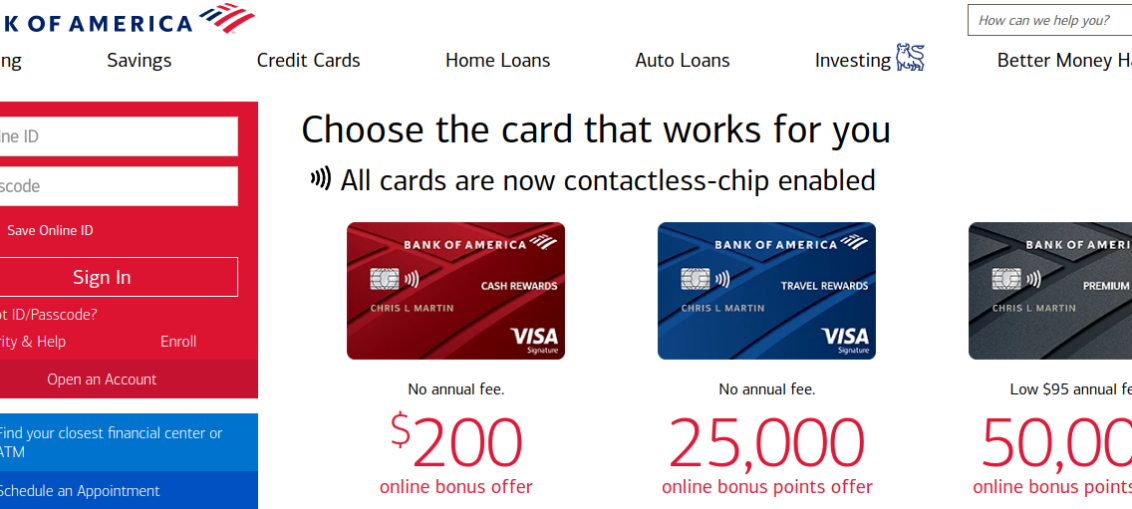

- Visit the Bank of America website (www.bankofamerica.com) using a web browser on your computer or mobile device.

- Click on the "Enroll" button located at the top-right corner of the homepage.

- Choose the type of account you have with Bank of America, such as personal or business.

- Provide the necessary identification and account information requested, which may include your Social Security number, account number, and date of birth.

- Set up your online banking username and password. Make sure to choose a strong password that includes a combination of letters, numbers, and special characters to enhance security.

- Select your preferences for receiving notifications and alerts from Bank of America.

- Review and agree to the terms and conditions of using Bank of America's online banking services.

- Verify your identity through the verification methods provided by Bank of America, such as answering security questions or receiving a code via email or text message.

- Once your identity is verified, you will gain access to your Bank of America online banking account.

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! However, how can we communicate?

Wonderful web site. Lots of useful info here. I’m sending it to a few friends ans additionally sharing in delicious. And obviously, thanks to your effort!

Simply wish to say your article is as amazing. The clearness in your post is just nice and i could assume you’re an expert on this subject. Well with your permission let me to grab your feed to keep updated with forthcoming post. Thanks a million and please carry on the gratifying work.

Nice blog here! Also your site loads up very fast! What host are you using? Can I get your affiliate link to your host? I wish my site loaded up as quickly as yours lol

obviously like your web-site but you need to test the spelling on quite a few of your posts. Several of them are rife with spelling problems and I to find it very troublesome to inform the reality on the other hand I’ll certainly come back again.

you are in reality a just right webmaster. The site loading velocity is incredible. It seems that you are doing any unique trick. In addition, The contents are masterwork. you have performed a wonderful task on this topic!

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! However, how can we communicate?

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! However, how can we communicate?

Somebody essentially lend a hand to make significantly articles I’d state. That is the very first time I frequented your website page and up to now? I surprised with the research you made to make this actual submit amazing. Wonderful task!

Fantastic site. A lot of helpful info here. I’m sending it to some buddies ans additionally sharing in delicious. And naturally, thanks on your sweat!

I have been surfing online more than 3 hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. In my opinion, if all web owners and bloggers made good content as you did, the web will be much more useful than ever before.